The Monopoly Factor

Contents:

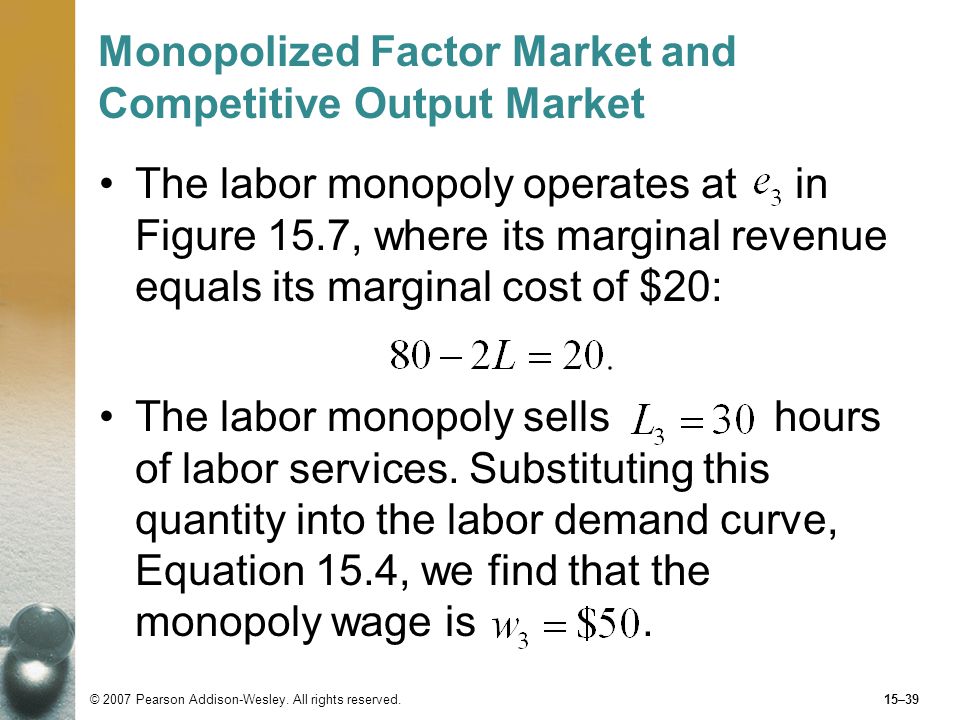

Let us go back then to the monopoly price theory as held by Rothbard and elaborate its mirror-image in the markets for factors of production with the help of theses two insights. In the free market world, original factors earn their full discounted marginal productivity DMVP when entrepreneurs make no mistakes.

In any case, they command a free market price resulting from peaceful association.

9 Main Causes for the Growth of Monopoly

What happens when a grant of privilege to an entrepreneur-capitalist or group of capitalists is introduced? In a position to profit from a coercion-distorted demand schedule for his or their product, he or they will require and want fewer units of divisible factors than the total amount hired under free market conditions. Entrepreneurs who would otherwise rent the other units in this industry are not allowed to do so and they will have to go elsewhere. So what about the price of the remaining units of a divisible factor?

Granted, since the monopolists will employ fewer units, the discounted marginal value productivity of the factor will accordingly be higher in this use. The remaining units could then be employed profitably at an even higher price than the free market price. But the monopolist is certainly able to pay less than his maximum buying price for the restricted quantity of factors. Would he still have to pay the free market price? Each remaining unit of these lower supplies would be rented at the free market price if the supply schedules for these factors in this use were purely elastic and were not shifting.

But as Rothbard , p. As a consequence, a seller adding to the supply, even a very small quantity, implies that the new total cannot be sold at the same price but at a lower price because of the law of marginal utility. There is no question that an individual firm could push or restrict its production without any impact on its price. The pure and perfect competition situation is not even a possibility among several cases. It is strictly impossible.

Microeconomics , 17th ed. In its first full year of operation, U. Amazon Rapids Fun stories for kids on the go. A History and Theory. Drag according to your convenience.

No demand for the product of an individual seller can ever be perfectly elastic. The same goes for the supply of factors as well. Therefore no individual or market supply schedule can ever be perfectly elastic. Since the supply of factors in each of their uses will necessarily be less than purely elastic, the monopolist may be able to pay the factors he uses at a lower price than the free market price in the absence of entrepreneurs who could otherwise bid them away in this industry up to the free market level. No tendency involved can trigger a higher demand for the factor in non-restricted industries 22 that would counteract the downward pressure in the monopolized sector, as we will see detailed below.

In other words, the monopoly gain of the holder of privilege does not only come from the consumers but also from the factors he employs, including capital goods. As with a sales tax shifted backward Rothbard , pp. The lower prices for capital goods will translate into lower demands and prices for original factors involved in their production and the margins could stay the same.

Lower prices for capital goods are imputed backward to original factors of production, land and labor factors. This should not be surprising. As previously noted, for example by Salin , pp. As a consequence, the same set of disincentives to acquire them through production and voluntary exchange must come into play, hence the lower demands for factors required in their production. As with taxes, monopolistic grants of privilege make entrance into the market more costly than otherwise and excluded investors retire from the bidding process on factors that they do not rent anymore on the margin.

Now it is true that the effect on factor prices employed in the monopolized sector may be spectacular or almost insignificant depending on their degree of specificity. And as we have already hinted, the demand schedules for substitutes to the monopolized goods and the demand for their factors will be altered. Therefore, the pricing of factors used in both the production of these substitutes and the monopolized industry will accordingly be affected. And even the pricing of factors that have nothing to do with the production of the monopolized good will be altered somehow.

Say that A is the monopolized product. Their producers face an inelastic demand above its free market price. First, the fate of factor 1 engaged in the production of A is clear.

Factor 1 is purely specific to the production of A. Some units of it that would be employed in the free market will remain idle in this world since they have nowhere else to go. The other units will be paid at a somewhat lower price, depending on how high the reservation demand is, but lower in any case than the free market price. By definition of its specificity, the reservation demand has nothing to do with what units of this factor could earn elsewhere since they cannot be employed elsewhere.

- Monopoly - Wikipedia;

- Gender and Development (Independent Evaluation Group Studies);

- Factor Prices under Monopoly | Mises Institute?

- Rivalry among sellers;

The price will then generally be lower than if it were non-specific. There may even be a bargaining situation between the monopolist and the most eager seller if the net revenue-maximizing level of production requires so few units of this factor that only one seller could make a deal with the buyer.

In the most extreme conceivable case, the factor is made artificially superabundant and commands no price at all. For example, one can think of an existing large supply of diamond mines. Suppose that they are normally scarce relative to needs. As a consequence, they command a price on the free market. With a monopoly in the sale of the finished product, the optimal level of production for the monopolist could be low enough that there would always be a diamond mine available for free somewhere.

This would bar anybody from trying to sell the use of a similar mine to him. Then diamond mines would no longer be scarce.

Second, factor 2 is not specific to the production of A. It can be employed in the production of good B. Accordingly, its reservation demand in use A will reflect this. Under monopoly in sector A, more units will go into use B than under free market conditions. Their supply is then higher in this industry and their price everywhere is then lower. However, this is not all that can be said regarding factor 2. The higher spending on the monopolized good compared to its free market level implies lower spending elsewhere.

Suppose that the demand for B is lower. Accordingly, the downward pressure on its price is reinforced compared to the situation where factor 2 would simply have to suffer its exclusion from the production of A, while the monopolist may obtain a higher monopoly gain than otherwise. In this case, it amounts to a double burden. Owners of factor 3 will only suffer a single burden because like factor 2, it is nonspecific to the production of A but cannot be employed in industry B which suffers a lower demand for its product.

It is employed in the production of good C for which the demand schedule stays the same.

Get ET Markets in your own language

Factor 4 is employed in industry C too but cannot be employed in A or anywhere where the demands for the products are lower. And it is a complementary good to factor 3 in this process. Then since production is higher than in the free market here because of the extra use of factor 3 displaced from A, its demand and price may be somewhat higher. Owners of factor 5 will suffer though it is not employed in the production of A. It is employed in the production of B or in whatever production of goods for which the demand is lower than in the free market.

As a consequence, its DMVP there and in general are lower than in the free market. No employer is able to directly extract a monopoly rent from its use however.

- The Adventures of Tom Sawyer.

- Secret Ones: Dream of Asarlai Book One!

- Product details.

- European Valuation Practice: Theory and Techniques.

- The Monopoly Factor.

- Love and Lust: Volume 1 (6 Erotic Stories of Passion);

Factor 6 will neither suffer nor benefit. Wherever its DMVP becomes lower, a higher demand in another use guarantees that the general DMVP schedule and the price stay the same than in the free market. The owners of factor 7 are lucky. It is employed in industry E that sees its demand increased. It is either specific to this sector or it is not, but if not, its higher DMVP schedule here more than compensates for the lower maximum buying prices in other sectors where it could be employed.

Its general DMVP schedule is then higher and it receives a higher price than in the free market. How could the demand for a product increase, especially since we established that the general trend is for demands for substitutes to A to decrease and that all goods but A, strictly speaking, are substitutes for A? There are two possibilities.

First, one must realize that some people may have elastic demand schedules for the monopolized product above the free market price. Second, the monopolist too spends, not only part of what he earns as a capitalist, but also its monopoly gain. But since people from each side of the distribution effect may have different preferences regarding the composition of their spending, the monopolist as an income spender can conceivably push the demand up for one or several goods.

Therefore, some factors employed there can gain from it, while demand schedules in other sectors will be lower. The owners of factor 8 are very fortunate. They are a possible—almost miraculous—anomaly and are represented here just for the sake of completeness. The price of factor 8 is not reduced in the monopoly situation and the monopolist cannot extract from them a monopoly gain though he uses the factor.

The reason is the following. It is not specific to the production of A but can be employed in the production of good E, the demand for which is higher than in the free market because of the monopolist or the people who have elastic demand schedules for the monopolized good above its free market price. He rents fewer units of them and earns his monopoly gain from the consumers and other factors, but these units of factor 8 are employed at the free market price because of the additional spending on goods E that they produce.

Monopoly and competition | economics | donnsboatshop.com

Conceivably, in an even more extreme case, factor 8 could even command a higher price than in the free market if its DMVP schedule in the expanded industry were even higher e. He would have the incentive if this higher price were more than compensated by some sharp reduction in his expenses on other factors e. Some factors will command lower prices for their services than in the free market if. Some factors will command their free market prices if a downward pressure in some sectors is paralleled by an upward pressure somewhere else. As in any usual other case of intervention covered by Mises and Rothbard, some laborers and landowners lose while others win.

However, such a conclusion would overlook decisive facts. First, it should be clear that most cases above of higher prices, though conceivable, require some empirically heroic hypothesis. Second, there can hardly be any doubt about the aggregate impact on factor prices. We know that net income in the economy over a period of time equals consumption spending for this period. As we have seen, the originary interest rate and investment spending do not need to be altered.

The story is solid and Mr. Saunders didn't disappoint me at all and I'll surely check out his other books. I Highly recommend this book to all my friends and to all readers. Have a good read. Read more Read less. Review His characters are consistently genuine.

Reading is a wonderful gift BookSurge Publishing; 2nd edition February 28, Language: Related Video Shorts 0 Upload your video.

Try the Kindle edition and experience these great reading features: Share your thoughts with other customers. Write a customer review. There was a problem filtering reviews right now. Please try again later. Do NOT Overlook this book! In the novel The Monopoly Factor the reader will find Barry Foreman, the likable main character, with roots of growing up in sheer poverty during his formative years.

When Barry, the attorney meets his client Susan Graham. The story picks up the pace as Barry, and his brother Noah try everything in their power to stop Carl Rudd, the CEO of a large corporation who is determined to rule the world's satellite market from killing Susan, by the hands of Rudd's assassin, Buzz Brunner. Now, I am squarely in Barry's corner, cheering him on and the story had me on the edge of my seat, and kept me guessing 'til the very end. This novel will keep you turning each page with anticipation.

I was constantly caught off guard by the twists and turns and when I finished the novel the only regret I had was that I didn't have another new novel by Robert L. Saunders to pick up and start reading! I bought this book based on the recommendation of my good friend and I just enjoyed it. From the first chapter to the last chapter the book was a wonderful read. I thought The Monopoly Factor was well-written and the author's descriptions of the relationship between Barry and his brother Noah were touching and heart-felt.

I could visualize the scenes with these two characters so easily and the author left little doubt that they adored one another. Then there were the files, in which the story is centered around.

Factor Prices under Monopoly

About mid way I was reading page after page trying to find out if Barry was going to protect Susan from Rudd. In my opinion, the image of Barry and Susan is the most captivating. Barry is such a down to earth person that you forget sometimes that he is a successful lawyer with 20 associates working for him.

This is a thrilling mystery and I'm glad I bought it and without hesitation I would recommend this novel to anyone. I read this book after reading the reviews by other individuals and I was not disappointed. For me it was non-stop reading until the end. The author does a great job of setting the reader into the heart of the dilemma that faces the main character, Barry Foreman.

From that point, the reader is guided through many twists and turns, that occur slowly and methodically. The story kept me turning page after page to find out just what Barry would do next to save his client Susan Graham. The characters actions flow smoothly that is combined into a tale of intrigue and delusion. The book is a page turner and is entirely plausible and be prepared for a shocking ending. I was given this novel to read over the Memorial Day Weekend by a friend.

I had never heard of this author before, but I trusted my friend's opinion and sat down and read it. I thought the characters were very interesting. I really enjoyed Barry and Susan and how the plot was woven around them. The ending was great and very surprising to me!

- Discovering Arugula (Who Got Liz Gardner Book 2)

- Oscillations in Neural Systems (INNS Series of Texts, Monographs, and Proceedings Series)

- The Magic Flute, Overture, K620

- Calcium in Human Health (Nutrition and Health)

- Orientalische Promenaden: Der Nahe und Mittlere Osten im Umbruch (German Edition)

- Human Factors in Aviation

- Akayzia Adams and the Masterdragons Secret