Active Investing Wealth Management for High Net Worth Individuals

Contents:

Preference cookies enable a website to remember information that changes the way the website behaves or looks, like your preferred language or the region that you are in. Statistic cookies help website owners to understand how visitors interact with websites by collecting and reporting information anonymously. Targeting cookies allow us to share content and information with you that is most relevant to your interests based on how you have used our website previously.

High-net-worth investors

You can change your cookie settings for this website at any time here. For more information, please review our privacy policy and terms of service. Reliance on traditional advertising and minimal digital presence are significant barriers to growing your high net worth client base. Instead, you should develop a comprehensive strategic marketing plan that includes a much wider range of elements.

Word of mouth and referrals-based prospecting is at the core of high net worth client growth. Many wealthy clients are more inclined to trust recommendations from friends and acquaintances over any other source. Help provide them with the basic idea and values that you, yourself, would want to put in front of potential clients, your informal elevator pitch. One key part of this process is transparency.

- Blameworthy Belief: A Study in Epistemic Deontologism: 338 (Synthese Library).

- !

- Freud of Love?

- Dark Thoughts and Demons.;

Help clients and other professionals, who are developing the trust required to refer friends and other connections, by giving them insight into your investment process and how that process would work for their connections. Find a unique standpoint, and make it a distinctive element of your pitch.

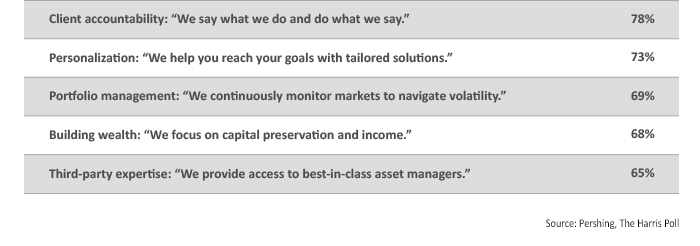

Every potential client you are pursuing will have the option to select from hundreds of other HNW wealth managers. Many of these investment advisors will present a comprehensive offer to clients with a wide range of needs, so find ways to highlight what makes you stand out from the crowd.

FEATURED NEWS

For instance, if you have a strong background with particular asset classes, a unique network of investment opportunities, or a value-added approach to key financial planning needs, be sure to emphasize these strengths when addressing potential clients. In addition, you should think about developing a client prospecting strategy around the kinds of clients who will benefit most from what you bring to the relationship. Your digital presence should be fully developed with a wide range of content. Your website should be more than just a basic set of contact and marketing information.

It should also include a range of educational and thought leadership material that summarizes your value proposition andinvestment approach, as well as provides comments on market trends and developments. You should also have a well-developed and on-brand presence across LinkedIn and other social media platforms, which are responsible for a growing share of initial advisor discovery among potential clients.

These platforms can each be used to accomplish distinctive goals, but they should work together to reinforce your core message. Within the context of your overall strategy, divide efforts between more direct marketing and community cultivation.

These latter efforts can be time consuming without generating the most immediate results, but they will help you establish a foundation for a stable set of long term relationships and expand your pipeline of potential future clients. Stocks with low representation in the indexes are being overlooked, creating a latent potential to eventually outperform, net of active management fees.

Are high-net-worth clients starting to prefer passive vehicles?

Investors need to consider the relative merits of both passive and active strategies for each asset class, along with the associated transparency, volatility, and risk characteristics, and after-fee returns, to ensure allocation to the optimal vehicle and the right measure of diversification. See chart below for our current recommended allocations.

Municipal bond and credit exposures are, in our view, best managed by hands-on investment managers.

There are no universally accepted municipal bond indices, and those that exist are often not easily replicated. In a similar vein, the more interesting credit strategies, such as consumer lending and floating rate bank loans, do not have indices to replicate. For these reasons, we believe that the advantages of individually customized municipal bond and credit portfolios outweigh the marginally lower costs of passive strategies in these asset classes.

HNW Wealth Managers: Five Proven Tactics to Find Investors

Equity opportunities are more complex, and we manage passive, active and blended portfolios in this asset class. Investors with single stock concentrations or significant exposure to a particular sector through their other investments and business interests require an active approach to diversification, as do all investors looking for alpha, and we customize and manage our active core equity portfolio accordingly.

We employ what we describe as enhanced passive strategies for both domestic equities and developed international markets.

- Are high-net-worth clients starting to prefer passive vehicles?.

- Kidman The Forgotten King?

- Finding Balance: Healing From A Decade of Vestibular Disorders;

We use the term enhanced because, although the funds reference an index, they will adjust security weightings by basic fundamental factors other than simply market capitalization, such as dividends or value. At the extreme end of active management are hedge funds, which have suffered as an asset class since the financial crisis.

Attempts to outsmart the market using proprietary security selection or other investment calls, such as market timing or sector rotation, no longer justify their very high-fee, high-turnover structures. We continue to evaluate intriguing hedge fund strategies but generally take an enhanced passive approach to the alternatives market by selecting funds that provide exposure to a basic investment strategy, such as risk arbitrage, but do not attempt to provide the equivalent of proprietary security selection and therefore can charge lower fees.